Student Loan Forgiveness for Teachers

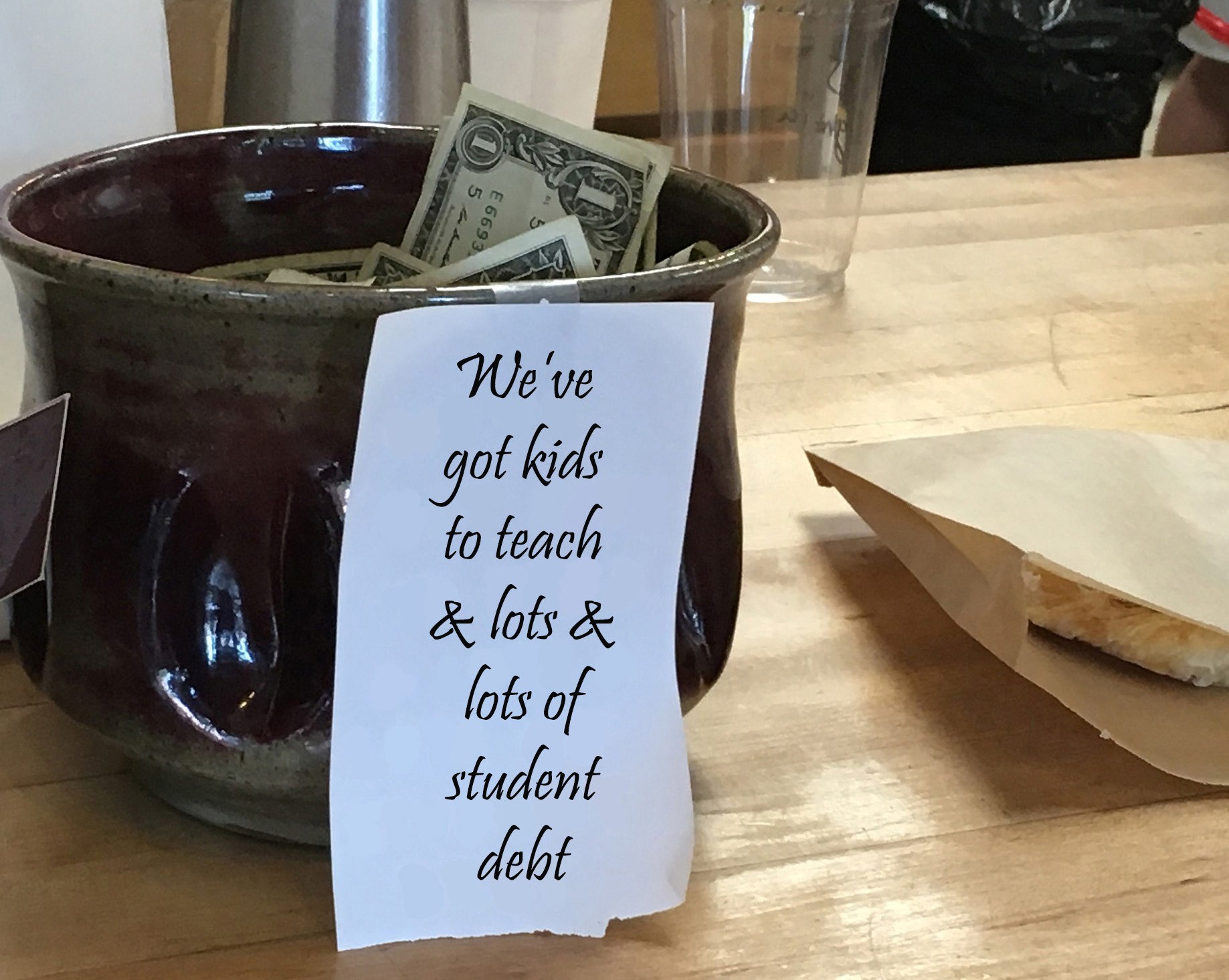

If I were to ask you what your favorite class in high school or college was, you’ll likely recall the teacher more than the class. Teachers have an undeniable influence on education, but higher education isn’t always so kind to our future teachers.

With student loans averaging in the tens of thousands of dollars, and average teacher salaries in California starting at around $40,000, it isn’t hard to see that student loans are a major obstacle to overcome.

Thankfully, there are student loan forgiveness programs for educators. Keep in mind that these are for federal student loans, not private loans. Let’s take a better look:

Public Service Loan Forgiveness (PSLF)

One of the most popular ways to forgive student loans, this program forgives the remaining balance on Direct Loans. The Federal Family Education Loan (FFEL) Program Loans and Perkins Loans may become eligible if they are consolidated into a Direct Consolidation Loan.

Requirements:

- 120 monthly payments have already been made

- Payments on FFEL and Perkins don’t count towards the 120 required payments

- Payments were made under a qualifying repayment plan

- You should repay your loans using the income-driven repayment plans if you’re seeking student loan forgiveness. (See the end of this article for info about these repayment plans and your taxes.)

- You work full-time for a qualifying employer, but it doesn’t have to be at a Title 1 school

Remember to submit the PSLF Employment Certification Form every year and every time you switch employers.

Apply here for the PSLF.

Teacher Loan Forgiveness

This option forgives one of two amounts of your Direct Subsidized and Unsubsidized Loans and your Subsidized and Unsubsidized Federal Stafford Loans.

Either:

$17,500 is forgiven if:

- You teach mathematics or science at the secondary level

- You teach special education at the elementary or secondary level

OR $5,000 is forgiven if:

- You teach full-time elementary or secondary level education that doesn’t include mathematics, science, or special education

If you have a Direct Consolidation Loan or a Federal Consolidation Loan, you may be eligible for forgiveness of the outstanding portion of the consolidation loan that repaid an eligible Direct Subsidized Loan, Direct Unsubsidized Loan, Subsidized Federal Stafford Loan, or Unsubsidized Federal Stafford Loan.

A Perkins Loan does not qualify.

Requirements:

- No outstanding balance on Direct Loans or FFEL Program loans as of 10/01/1998 or on the date that you obtained a Direct Loan or FFEL Program loan after 10/01/1998.

- You’ve worked full-time as a highly-qualified teacher for 5 complete and consecutive academic years.

- You’re employed at an eligible Title I low-income school. See if your school qualifies here.

- The loan that you want forgiveness for must have been made before the end of your 5 academic years of qualifying teaching service.

Can I have loans forgiven through the Teacher Loan Forgiveness Program AND the PSLF program?

Yes, but not for the same period of teaching service. If you complete 5 years of qualified service, the payments you make will not count towards the 120 payments required under the PSLF. 120 additional payments must be made. Keep in mind:

*The PSLF program forgives the entire amount after 10 years so unless you’re planning on working less than 10 years, the PSLF is your best option.

*Federal Family Education Loans (FFEL) do not qualify for PSLF. If you haven’t consolidated, go with the Teacher Loan Forgiveness program first, then consolidate your loans to qualify for PSLF.

Apply here for Teacher Loan Forgiveness.

Perkins Loan Teacher Cancellation

Up to 100% of your Federal Perkins Loan may be cancelled over a period of 5 years. A small part is forgiven every year according to a scale:

Year 1: 15% forgiven

Year 2: 15% forgiven

Year 3: 20% forgiven

Year 4: 20% forgiven

Year 5: 30% forgiven

Requirements:

- Employed full-time in a public or non-profit elementary or secondary school:

- Teacher at a low-income Title I school OR

- Special education teacher OR

- Mathematics, science, foreign language, or bilingual education teacher or in any other field of expertise determined by a state education agency to have a shortage of qualified teachers in that state

- Go here for a listing of Teacher Shortage Areas nationwide

To apply, contact the school that issued the loan or with the school’s Perkins Loan servicer.

State-Based Loan Forgiveness Programs

Check out the link for more information about your state. California does offer the Assumption Program of Loans for Education (APLE) program, but no new applications have been accepted since the 2011-2012 school year.

And last but not least . . . what about my taxes?

Income-driven repayment plans

With this type of repayment plan, the payment does not exceed 10-20% of your discretionary income. The loan term is increased from the standard 10 years to 20-25 years, and any remaining loan balance is forgiven at the end of the term. However, it IS considered taxable income. See here for more information.

Good news! Student loan amounts under the three plans below are NOT considered taxable by the IRS.

For more information on each, see these links below:

Public Service Loan Forgiveness (PSLF)

Teacher Loan Forgiveness Program

Perkins Loan Teacher Cancellation

So . . . feeling overwhelmed?

You’re not alone! Rest assured that there are plenty of resources out there to guide you. The California Teachers Association has created a video, and it offers resources available to educate you.

You’ve devoted your life to educating others. Now take some time to educate yourself. When the reward could mean erasing thousands of dollars of student debt, this crash course will be well worth your time.